Ubiquitous Software Solutions Inc.

Advanced AI-powered tools for regulatory compliance and call center optimization. Helping you run your organization better.

Callsight

Powerful insights into your call center's activity, helping you optimize operations and improve customer experience.

- Track calls

- Understand your clients

- Train your agents

trAIce

Anti-money laundering and fraud solution for transaction monitoring.

- AML Monitoring

- Fraud Detection

- Compliance and Contract Analytics

PolicyHub

PolicyHub is an AI-driven tool that automates regulatory compliance reviews and identifies gaps in company policies.

- PCMLTFA

- Fraud Detection

- Compliance and Contract Analytics

About Us

Ubiquitous Software is a Toronto-based technology firm specializing in regulatory compliance solutions powered by advanced artificial intelligence. Our innovative platform helps organizations streamline compliance processes by analyzing legislation and identifying gaps in internal policies and procedures. With a focus on the financial services and banking sectors, we provide AI-driven insights, consulting services, and staff augmentation to ensure our clients stay ahead in a constantly evolving regulatory landscape.

Transforming Regulatory Compliance

Ubiquitous Software is revolutionizing how organizations handle regulatory compliance. Our innovative platform leverages advanced artificial intelligence to streamline compliance processes, analyze legislation, and identify gaps in internal policies and procedures.

With a dedicated focus on the financial services and banking sectors, we provide AI-driven insights, consulting services, and staff augmentation to ensure our clients stay ahead in a constantly evolving regulatory landscape.

AI-Powered Solutions

Leveraging cutting-edge artificial intelligence to transform regulatory compliance.

Industry Expertise

Deep knowledge of financial services and banking sector requirements.

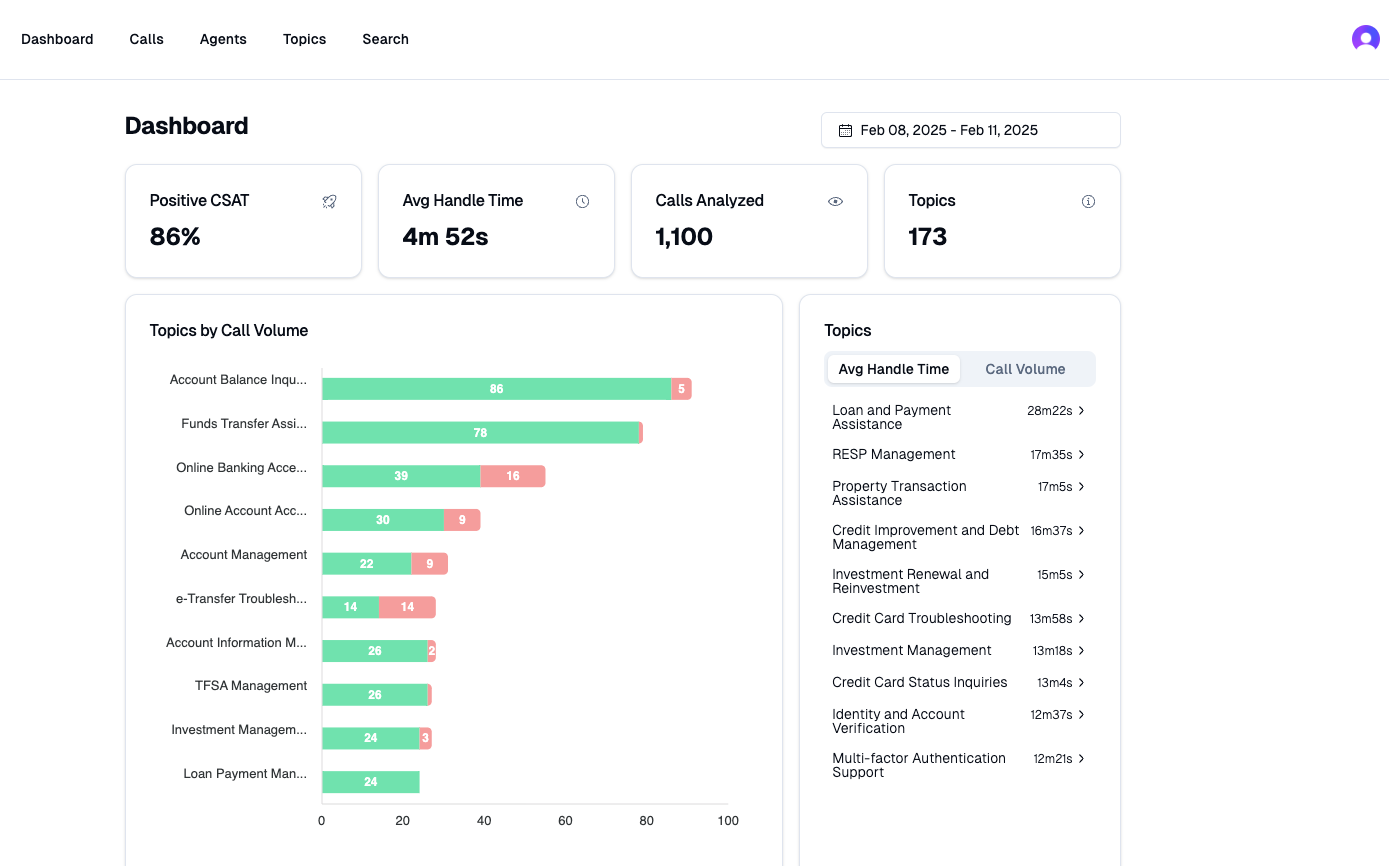

Callsight

Powerful Call Center Insights

CallSight provides powerful and deep insights into your call center activity, helping you understand your customers better and optimize your operations.

Smart Summaries

Accurate, AI-powered call summaries and trend reporting

Opportunity Detection

Automated identification of sales opportunities

Fraud Prevention

Advanced scanning and detection of potential fraud

Sentiment Analysis

Detailed sentiment scoring for agents and clients

Comprehensive Call Analysis

Get detailed insights into every call with our advanced sentiment analysis and automated summarization technology. Track agent performance, customer satisfaction, and identify key topics and trends.

- Automated call summarizations by topic and trend analysis

- Understand when sales happen and identify sales opportunities

- Find, detect and prevent fraudulent activities

- Understand your clients better and train your agents

PolicyHub

Regulatory compliance, simplified

PolicyHub is an artificial intelligence-powered tool you can leverage to assess your company's documentation against regulations.

Automated Compliance Review

Instantly analyze new legislation and compare it against internal policies, ensuring compliance without manual effort.

Gap Identification & Risk Mitigationn

Detect discrepancies between company policies and regulatory requirements, reducing legal and financial risks.

AI-Powered Policy Recommendations

Leverage advanced AI to suggest precise updates and improvements to policies and procedures, ensuring alignment with the latest laws.

Efficiency & Cost Savings

Significantly reduce the time and resources needed for regulatory reviews, freeing compliance teams to focus on strategic initiatives.

Our Services

Retail Payments Activities Act Cybersecurity and IT Assessments

Comprehensive operational and technical assessment for Retail Payment Activities Act compliance, ensuring your organization meets all regulatory requirements.

- • Full compliance evaluation

- • Technical infrastructure review

- • Risk assessment reports

- • Through our partnership with the AML Shop we are able to provide a complete RPAA assessment for your firm's ability to meet the rules for the Retail Payments Activities Act.

White Label Software

Customized software for your company. Our engineers and developers can build software that meets your needs quickly and cheaply.

- • White Label AI Solutions – We provide cutting-edge AI-driven tools that businesses you can brand as your own.

- • Flexible Ownership Models – We can build it, you can own it.

- • Customized For Your Needs – Built using industry best practices, we design for your needs

Consulting Services

Our staff of financial industry experts have worked the country's largest financial institutions and understand industry standard work quality and best practices.

- • Expert IT & Engineering Support – Augment your teams with top-tier IT professionals, software engineers, and cloud specialists to drive digital transformation and operational efficiency.

- • Regulatory & Compliance Advisory – Ensure alignment with evolving financial regulations by leveraging our expert consultants, who provide strategic insights and risk mitigation guidance.

- • Tailored Staffing Solutions – Scale your workforce seamlessly with highly skilled professionals in development, business analysis, cybersecurity, and regulatory compliance, ensuring you meet project demands efficiently.

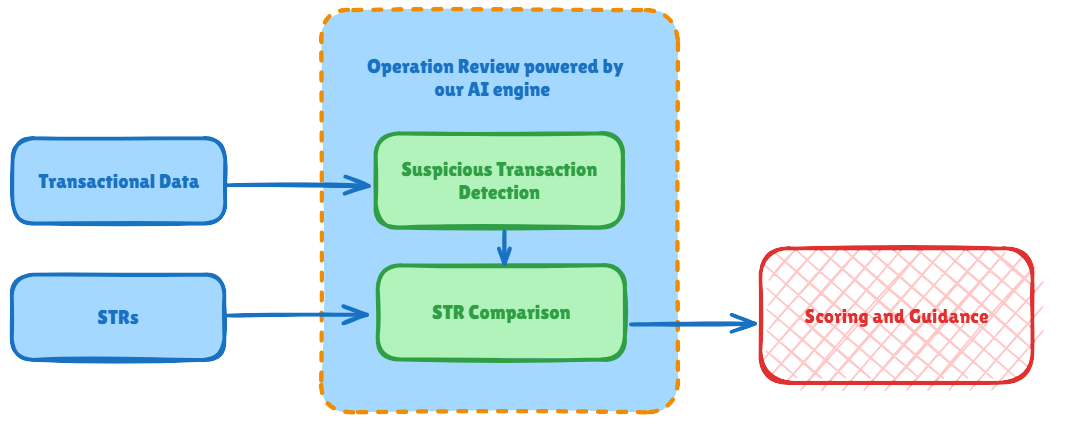

Operational Review Hub

Advanced platform for transaction monitoring and compliance filings, featuring automated suspicious activity detection and Fintrac Suspicious Transaction Report (STR) generation.

- • Transaction monitoring

- • Automatically generates STRs from your transaction data

- • Reviews historic transaction data for missed STRs

- • Reviews previously filed STRs and checks for missing or incorrect information

- • Risk level scoring

Strategic Partnership

Framework Assessment

Complete evaluation of your risk management systems and procedures

Compliance Strategy

Tailored recommendations for meeting the Retail Payments Activities Act standards

Reporting Readiness

Review and assessment of your firm's reporting capabilities

Best Practices and Recommendations

Solid, actionable recommendations for cybersecurity and information technology organizational gaps

Get Started

Have questions about our products or services? We'd love to help!